Blog and Insights

Mastering the Complexities of Multi-Faceted Financial Reporting

Juggling the Multiverse: CFOs Navigating Multi-Everything Financial Reporting Preparing accurate and transparent financial reports has become an increasingly complex process, particularly for multinational corporations with operations spanning diverse countries, languages, business segments, and currencies. This complexity arises from the need to comply with a multitude of distinct accounting standards, regulatory requirements, and tax laws, while simultaneously consolidating financial information across disparate entities. Managing this process effectively demands skilled professionals who can decipher the nuances of each jurisdiction and ensure timely and accurate reporting. Understanding the Scope of Multi-Faceted Financial Reporting Multi-Company Dynamics Multi-company financial reporting not only requires the consolidation of financial data but also demands a nuanced understanding of each subsidiary’s unique financial context. This includes recognizing the distinct economic conditions, market dynamics, and customer bases that each entity engages with, which can significantly influence their financial outcomes. Additionally, managing the differing fiscal years, accounting cycles, and financial reporting standards of each subsidiary adds another layer of intricacy. The ultimate goal is to create a comprehensive and cohesive financial report that accurately represents the collective performance of all companies within the umbrella organization, while also respecting the individuality of each entity’s operations and financial characteristics. Multi-Language Challenges Beyond mere translation, multi-language financial reporting demands a deep cultural and contextual sensitivity to ensure that financial concepts and practices are accurately conveyed in each language. This involves understanding the subtleties and nuances of financial terminology, which can vary significantly from one culture to another, potentially leading to misinterpretations if not handled carefully. Additionally, companies must also look into the legal and regulatory implications of financial disclosures in different languages, ensuring compliance and consistency across all jurisdictions. Effective communication in multi-language reporting is crucial to maintaining transparency with international stakeholders, investors, and regulatory bodies, and to uphold the integrity of the company’s financial information globally. Multi-Currency Considerations Effectively managing financial reporting in multi-currency environments demands deep knowledge of currency risk management and hedging strategies. Exchange rate volatility can lead to significant fluctuations in reported revenues, expenses, and profits, making it essential for companies to accurately capture and report these changes. Furthermore, the choice of a functional currency for consolidated reporting and the application of different currency translation methods for different types of transactions (such as the current rate method or the temporal method) add layers of complexity. It is critical for companies to establish robust policies and systems to monitor and adjust for currency exchange impacts, ensuring that financial statements provide a true and fair view of the company’s financial position in a global context. Complexity in Consolidation and Standardization: The complexity in consolidation and standardization extends to harmonizing diverse financial practices and aligning them with international reporting standards. This process often involves reconciling various accounting treatments for similar transactions, which can differ across subsidiaries due to local regulations or practices. Additionally, the task of consolidating financial statements is compounded when dealing with subsidiaries that have different fiscal year-ends or operate in markedly different economic environments. This necessitates not only a thorough understanding of each entity’s financials but also an ability to integrate and present these in a cohesive manner. Accurate consolidation ensures that stakeholders, including investors and regulatory bodies, receive a transparent and comprehensive view of the company’s overall financial health, making this an essential aspect of effective financial management in multinational corporations Group Reporting and Intercompany Transactions: In group reporting, managing intercompany transactions is a critical challenge, as these transactions can significantly distort the financial picture if not properly accounted for. This includes the need to eliminate intercompany profits, debts, and investments to prevent double counting and to present a true financial position of the entire group. Additionally, variations in transfer pricing and cost allocation methods used by different entities within the group further complicate the reconciliation process. A robust system for group reporting, therefore, must be capable of handling complex data flows and providing clear visibility into all intercompany transactions. It should also offer advanced analytical capabilities to ensure that all eliminations and adjustments are made accurately, thereby maintaining the integrity of the group’s consolidated financial statements. Currency factors: Currency translation in financial reporting is not merely a technical exercise; it reflects the economic realities of operating in global markets. Exchange rate fluctuations can have a significant impact on the reported value of assets, liabilities, income, and expenses, leading to potential distortions in financial performance and position if not managed correctly. This necessitates employing sophisticated currency translation methodologies that align with both accounting standards and the economic essence of the underlying transactions. Additionally, companies must consider the impact of currency translation on tax implications and cash flow management, as these can materially affect strategic decision-making and investor perceptions. Understanding these economic implications is critical for providing stakeholders with a clear and accurate picture of a multinational corporation’s financial health in a globally integrated economy. Strategies for Effective Multi-Faceted Financial Reporting Integrated Financial Reporting Systems: Implementing advanced financial reporting systems that can handle multi-company, multi-language, multi-group, and multi-currency data is crucial. Such systems should offer functionalities like automatic currency conversion, consolidation, and language translation capabilities. Standardization of Reporting Processes: Standardizing reporting processes across all entities ensures consistency and efficiency. This includes adopting uniform accounting policies and practices, where feasible, across all companies and groups. Expertise in International Financial Reporting: Employing financial experts who are well-versed in international accounting standards and multi-currency transactions can provide valuable insights. Continuous training and development are essential to keep up with the evolving financial reporting landscape. Leveraging Technology for Efficiency: Embracing cloud-based solutions and automated tools can streamline the financial reporting process, reducing manual errors and saving time. These technologies can also facilitate real-time reporting and analysis, enhancing decision-making capabilities. Finally…. Multi-company, multi-language, multi-group, and multi-currency financial reporting requires a sophisticated approach to achieve accuracy and compliance. This complexity demands integrated systems capable of handling diverse data, as well as expertise in international financial standards and currency management. To effectively manage this challenge, companies must leverage process leadership and advanced technology and standardized

What is Integrated Financial Planning and Why is it Important?

Jim’s dilemma Jim, a CFO of a rapidly expanding tech enterprise, often found himself caught in the whirlwind of numbers, projections, and strategies. As he...

What Is a Financial Report Audit & How to Prepare for One

Breeze through your next Financial Reporting Audit When it comes to understanding the financial health of a business, financial reports are invaluable. However, it’s important...

Solving the Multi-GAAP Nightmare of International Financial Reporting

Navigating the “Labyrinth” of International Financial Reporting Financial reporting is continually evolving, and with it comes the challenge of navigating various accounting standards and frameworks....

AI in Financial Reporting: “Not quite there yet”

AI: Are we there yet? Artificial Intelligence (AI) has been hailed as a panacea for various industries, promising revolutionary advancements in efficiency and accuracy. One...

Mondial/aclaros enrich Financial Reporting in Mid-Market ERP

Accelerate Financial Reporting for Mid Markets BEDFORD, New Hampshire, June 15, 2023. Mondial Software and Aclaros partnered to advance financial reporting for mid-market companies, including...

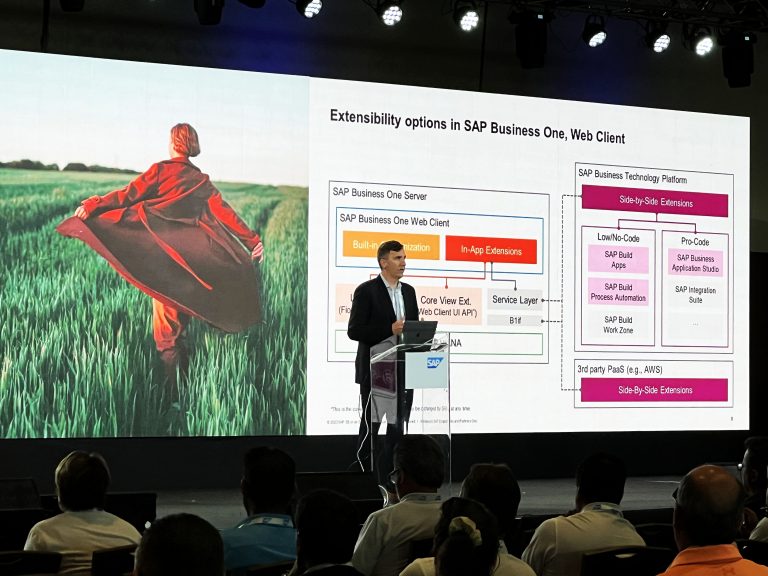

Takeaways SAP Partner Summit for Small to Midsize Enterprise

Key Takeaways and Learnings: Mondial Software participated in the recent 2023 SAP Partner Partner Summit for Small to Mid-Sized Enterprise (SME). At the event, we...

How to Fix Common Charts of Accounts Challenges in Financial Reporting

The Charts of Accounts Mystery. The charts of accounts (COA) is a fundamental tool used in financial reporting, additionally serving as a vital component of an...

Over-Reliance on IT a Key Risk in Supporting Financial Reporting?

Discover the potential risks and dangers of over-Reliance on IT in supporting financial reporting and accounting.

Mondial goes to the 2023 SAP Partner Summit for SME!

We’ll be in Vienna and Panama City Mondial will be in attendance at the 2023 SAP Partner Partner Summit for SME in both Panama City...